Every squad has its flashy talker and its quiet achiever. While the former grabs attention, the silent ones often deliver real surprises.

In the crypto world, USUAL coin appears to be that silent achiever—growing over 100% in just a month without making much noise.

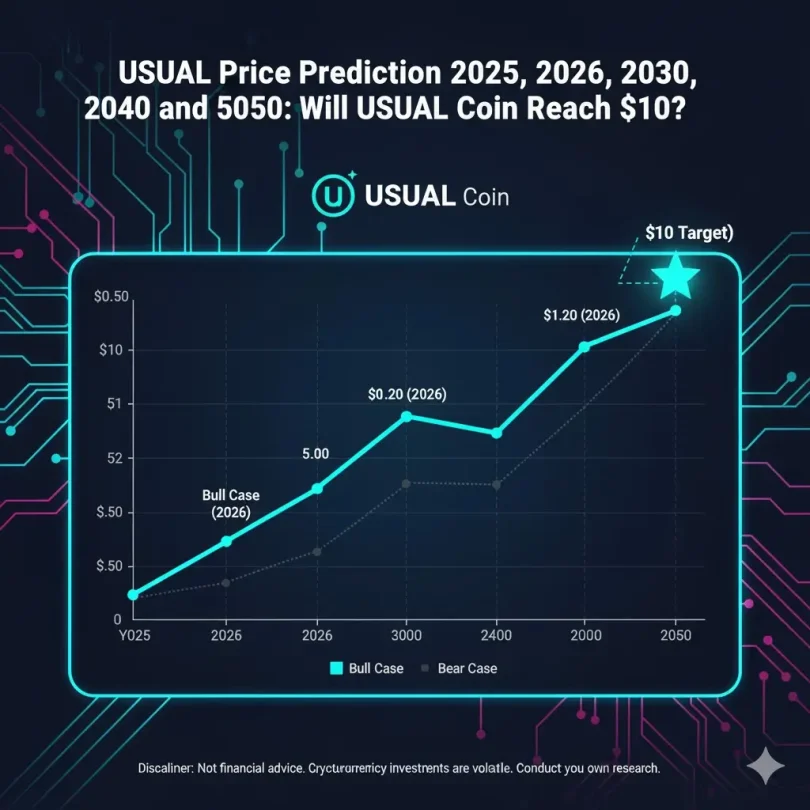

But has USUAL’s momentum stalled, or is it gearing up for an even bigger leap? Let’s explore that question in this detailed analysis of USUAL price predictions for 2025, 2026, 2030, 2040, and 2050. And for those watching key milestones, we’ll also answer: “Will USUAL reach $10?”

A Quick Overview of USUAL

Usual is a decentralized fiat stablecoin issuer that returns value, ownership, and governance to its users. Unlike centralized stablecoin issuers that benefit only insiders, Usual redistributes the majority of value to its community. According to its official website, 90% of its value flows back to users through shared rewards.

USUAL is the governance token of this ecosystem, enabling the platform to redistribute ownership and control back to its users.

Beyond USUAL, the platform features two other key tokens: USD0 and USD0++. USD0 is the world’s first RWA stablecoin backed by risk-free assets like US Treasury bill tokens, while USD0++ is the liquid staking version of USD0, with a four-year lock-up period.

The Usual platform collects yield generated by the collateral backing its stablecoin, USD0. Then, unlike centralized stablecoin issuers like Tether and Circle that retain the entire yield, Usual redistributes it to holders of its native token, USUAL. However, it doesn’t do this directly as cash flow—it retains the amount within the protocol, enhancing the intrinsic value of the USUAL token. Out of 100% of the protocol’s revenue, it distributes 90% to the community via USUAL tokens.

USUAL’s tokenomics are strategic for long-term value. Its issuance constantly adjusts with the protocol’s revenue growth. Plus, the emission of USUAL is deflationary—as the TVL of USD0++ rises, the emission rate decreases. So, as the protocol’s TVL and revenue increase, fewer USUAL tokens are issued. Ninety percent of the USUAL token supply is allocated to the community, with only 10% reserved for teams and investors.

Since its launch on November 19, 2024, USUAL has surged over 176% in less than two months.

| Key Metrics | Value |

|---|---|

| USUAL Market Cap | $469.27M |

| USUAL Rank by Market Cap | #172 |

| USUAL Circulating Supply | 504.63M USUAL |

| USUAL Total Supply | 530.35M USUAL |

| USUAL Maximum Supply | 4B USUAL |

| USUAL All-time High | $1.64 |

| USUAL All-time Low | $0.2055 |

But will USUAL maintain this upward momentum?

Let’s explore the USUAL price predictions for 2025, 2026, 2030, 2040, and 2050.

USUAL Price Prediction 2025

Growth and trends in the stablecoin market can directly impact USUAL’s price trajectory for 2025. According to a report by Metatechinsights, the stablecoin market reached $182.6 million in 2024 and is expected to climb to $1,106.8 million by 2035. This means it could grow with a CAGR of 17.8% between 2025 and 2035—a positive sign for projects like Usual operating in the stablecoin category.

The rising use of stablecoins in payments is another factor favoring USUAL coin’s future. In 2024, nearly $17 trillion in stablecoin transactions were completed, with payments accounting for $5 trillion. This represents over 33% of the volume processed by Visa, indicating a gradual preference shift.

This also means 2025 could mark a significant shift in global payment volume from off-chain to on-chain. With rising B2B adoption of stablecoins in 2024, we may witness broader individual adoption this year as various marketplace platforms plan to enable international creators, sellers, and hosts to receive payments in stablecoins.

However, the Usual project must overcome the dominance of centralized stablecoins like USDT and USDC to drive demand for its stablecoin, USD0. The crypto financial market prefers Tether’s USDT and Circle’s USDC and may hesitate to try new alternatives. A key reason behind this mindset is the shadow of past collapses like Terra LUNA and its stablecoin TerraUSD.

The Usual platform must offer compelling advantages for its stablecoin to stand out. If executed well, it could spark demand for decentralized stablecoins, with the platform at the heart of this movement.

The record-breaking profits of centralized coin issuers like Tether could also serve as a wake-up call, prompting people to recognize the value in decentralized alternatives where they can share in the profits. Since USUAL’s marketing directly highlights the pain points of USDT users who cannot participate in its profits, it is likely to gain attention and momentum.

Competitor Analysis:

- CoinMarketCap predicts a moderate increase for USUAL, estimating it could reach $2 by the end of 2025, based on current growth rates and market trends.

- CryptoPredictions.com forecasts a more bullish scenario, projecting USUAL to climb to $5 by 2026, assuming successful adoption and partnerships.

- WalletInvestor offers a more cautious estimate, suggesting USUAL may stabilize around $1.50 by 2025, citing market volatility and regulatory uncertainties.

Considering these scenarios and possibilities, our USUAL price prediction for 2025 ranges between $0.95 (minimum) to $3.2 (maximum), with an average price level of $1.9.

The same USUAL price prediction for 2025 in INR is: ₹82 (minimum), ₹275 (maximum), and ₹163 (average).

| USUAL Coin Price Prediction 2025 | Maximum Price | Minimum Price | Average Price |

|---|---|---|---|

| USUAL Price Prediction 2025 in USD | $3.2 | $0.95 | $1.9 |

| USUAL Price Prediction 2025 in INR | ₹275 | ₹82 | ₹163 |

USUAL Price Prediction 2026

Our USUAL price prediction for 2026 remains bullish. Since the core feature of the Usual protocol is issuing decentralized stablecoins, it is likely to stay relevant in the coming years.

Moreover, concerns regarding the monopoly of certain centralized stablecoins like Tether (USDT) are rising. In a research report, JP Morgan stated that the increasing dominance of stablecoin Tether (USDT) is concerning for the crypto ecosystem. It also expressed concerns about how increasing concentration in Tether over the past year could prove negative for the stablecoin universe.

Multiple industry players are seeking better alternatives to Tether (USDT) with improved transparency, decentralization, and capabilities. At such a time, Usual protocol’s native stablecoin USD0 could emerge as a viable option and capture a wider share of the stablecoin market.

The USUAL price could appreciate significantly by 2026 due to its direct link with the USD0 stablecoin and the Usual Protocol’s growing popularity.

Competitor Analysis:

- CryptoPredictions.com forecasts a bullish scenario, projecting USUAL to climb to $5 by 2026, assuming successful adoption and partnerships.

- LongForecast provides a conservative estimate, projecting USUAL to reach $3 by 2027, based on gradual adoption and steady growth patterns.

With that said, our USUAL price prediction for 2026 in USD is: $3.1 (minimum), $6.7 (maximum), and $4.7 (average).

This USUAL price prediction for 2026 in INR becomes: ₹266 (minimum), ₹576 (maximum), and ₹404 (average).

| USUAL Coin Price Prediction 2026 | Maximum Price | Minimum Price | Average Price |

|---|---|---|---|

| USUAL Price Prediction 2026 in USD | $6.7 | $3.1 | $4.7 |

| USUAL Price Prediction 2026 in INR | ₹576 | ₹266 | ₹404 |

USUAL Price Prediction 2030

USUAL is deflationary and has a limited supply of 4 billion tokens. If Usual Protocol achieves steady growth, rising demand could impact its circulation in the market. Additionally, USUAL’s maximum supply of 4 billion will be unlocked by 2028, ensuring no new USUAL tokens are created afterward. This reduced supply combined with increased demand could positively impact its price.

Let’s not forget the rising volumes of stablecoins. With the expansion of the crypto market, demand for various stablecoins is expected to surge. Due to its unique mechanism and model, Usual protocol’s USD0 coin could become a key contender among the most widely used stablecoins backed by the US dollar by 2030. On the other hand, an unpredictable black swan event could eliminate trust in the Usual Protocol.

Competitor Analysis:

- DigitalCoinPrice offers a long-term outlook, suggesting USUAL could potentially reach $8 by 2030, driven by technological advancements and increased use cases.

- WalletInvestor provides a conservative estimate, indicating that USUAL may experience slower growth, reaching approximately $3 by 2030, with gradual adoption over time.

Balancing both scenarios, our USUAL price prediction for 2030 in USD is: $6.3 (minimum), $9.5 (maximum), and $8.1 (average).

In INR, this USUAL price prediction becomes: ₹541 (minimum), ₹816 (maximum), and ₹696 (average).

| USUAL Coin Price Prediction 2030 | Maximum Price | Minimum Price | Average Price |

|---|---|---|---|

| USUAL Price Prediction 2030 in USD | $9.5 | $6.3 | $8.1 |

| USUAL Price Prediction 2030 in INR | ₹816 | ₹541 | ₹696 |

USUAL Price Prediction 2040

By 2040, USUAL could solidify its position as a transformative force in the decentralized finance (DeFi) landscape. With its deflationary tokenomics and community-centric model, the potential for growth in USUAL price prediction 2040 remains significant.

The protocol’s strategy of redistributing 90% of its revenue to token holders gives USUAL a competitive edge over centralized counterparts. If this trend continues, USUAL could benefit from constrained supply and increased adoption.

However, challenges such as regulatory scrutiny, market competition, and potential technological disruptions must be considered.

Competitor Analysis:

- Gov.Capital offers an optimistic forecast, estimating USUAL could potentially reach $7 by 2028, contingent on significant technological advancements and broader market acceptance.

Based on these factors, our USUAL price prediction 2040 suggests a range of $25 (minimum) to $60 (maximum), with an average price of $42.

In INR terms, this translates to ₹2,148 (minimum), ₹5,155 (maximum), and an average of ₹3,608.

| USUAL Coin Price Prediction 2040 | Maximum Price | Minimum Price | Average Price |

|---|---|---|---|

| USUAL Price Prediction 2040 in USD | $60 | $25 | $42 |

| USUAL Price Prediction 2040 in INR | ₹5,155 | ₹2,148 | ₹3,608 |

USUAL Price Prediction 2050

By 2050, USUAL could emerge as a leading option in the decentralized stablecoin ecosystem. With its deflationary supply mechanics and a revenue-sharing model benefiting holders, USUAL Price Prediction 2050 reflects immense potential for value appreciation.

Our USUAL price prediction 2050 estimates a range of $85 (minimum) to $97 (maximum), with an average of $91.

This USUAL price prediction 2050 in INR translates to ₹7,303 (minimum), ₹8,334 (maximum), and ₹7,818 (average).

| USUAL Coin Price Prediction 2050 | Maximum Price | Minimum Price | Average Price |

|---|---|---|---|

| USUAL Price Prediction 2050 in USD | $97 | $85 | $91 |

| USUAL Price Prediction 2050 in INR | ₹8,334 | ₹7,303 | ₹7,818 |

Below is a compiled table of all USUAL price predictions for 2025, 2026, 2030, 2040, and 2050 in USD:

| USUAL Coin Price Predictions (USD) | Maximum | Minimum | Average |

|---|---|---|---|

| 2025 | $3.2 | $0.95 | $1.9 |

| 2026 | $6.7 | $3.1 | $4.7 |

| 2030 | $9.5 | $6.3 | $8.1 |

| 2040 | $60 | $25 | $42 |

| 2050 | $97 | $85 | $91 |

The same USUAL price prediction in INR for these years is as follows:

| USUAL Coin Price Predictions (INR) | Maximum | Minimum | Average |

|---|---|---|---|

| 2025 | ₹275 | ₹82 | ₹163 |

| 2026 | ₹576 | ₹266 | ₹404 |

| 2030 | ₹816 | ₹541 | ₹696 |

| 2040 | ₹5,155 | ₹2,148 | ₹3,608 |

| 2050 | ₹8,334 | ₹7,303 | ₹7,818 |

NOTE: All INR prices in this price prediction blog are based on current USDT-INR exchange rates (1 USDT = INR 83).

Will USUAL Reach $10?

Whether USUAL will reach $10 depends on various factors including its total supply, upward potential, market trends, and internal developments. Since its launch, USUAL has demonstrated solid performance, surging over 107%. It has also achieved a market cap of $469.27 million—a respectable figure for a project focused on decentralized fiat issuance.

With its unique use case of issuing fiat-backed stablecoins that are decentralized and return a share of profits to users, USUAL has strong potential for adoption and popularity. Moreover, its deflationary supply is another factor that could significantly drive up its price over time. Considering all these factors, it is possible for USUAL to reach $10, though this may take considerable time.

The current all-time high of USUAL is $1.64, and it’s trading over 50% below this price. From here, USUAL needs to surge over 1,349%. While such increases are possible for meme coins, they are quite rare for altcoins. Thus, it will take USUAL a substantial amount of time to hit the $10 mark.

Factors Influencing USUAL Price

Several key factors could influence USUAL’s price trajectory:

Regulatory Landscape: The regulatory environment surrounding stablecoins and cryptocurrencies continues to evolve. Favorable regulations could boost USUAL’s adoption, while restrictive policies could hinder growth.

Technology Advancements: Continuous improvements to the Usual protocol, including enhanced security features, scalability solutions, and user experience upgrades, could attract more users and increase demand for USUAL.

Market Competition: The stablecoin market is highly competitive. USUAL’s ability to differentiate itself from established players like USDT and USDC will be crucial for its success.

Partnership and Adoption: Strategic partnerships with payment processors, DeFi platforms, and traditional financial institutions could significantly expand USUAL’s use cases and user base.

Macroeconomic Conditions: Broader economic factors, including inflation rates, interest rates, and global financial stability, can impact cryptocurrency markets and investor sentiment toward USUAL.

Risk Assessment

Investing in USUAL coin carries several risks that potential investors should carefully consider:

Market Volatility: The cryptocurrency market is highly volatile, and USUAL coin is subject to sudden and significant price swings, which can result in substantial losses.

Regulatory Uncertainty: Regulatory environments surrounding cryptocurrencies are still evolving, and new regulations could negatively impact the value and utility of USUAL coin.

Technological Risks: Technical vulnerabilities or failures in the blockchain platform could compromise the security and functionality of USUAL coin.

Liquidity Risk: USUAL coin may experience periods of low trading volume, making it difficult to buy or sell without significantly affecting the price.

Competition: The cryptocurrency market is highly competitive, and USUAL coin faces competition from established and emerging cryptocurrencies, which could affect its market share and adoption.

Project Execution: The success of USUAL coin depends on the project’s ability to execute its development roadmap and achieve its goals, which may be subject to delays or challenges.

Security Risks: USUAL coin is susceptible to hacking and theft, which could result in loss of funds.

Concentration Risk: A small number of holders may control a significant portion of USUAL coin, which could lead to market manipulation and price volatility.

Expert Opinions

While specific expert opinions on USUAL are still emerging given its recent launch, several industry analysts have noted the growing importance of decentralized stablecoins. Blockchain experts emphasize that projects offering genuine utility and community governance, like Usual, could capture market share from centralized alternatives as regulatory scrutiny intensifies.

DeFi analysts have pointed out that the revenue-sharing model employed by USUAL represents an innovative approach that could attract users disillusioned with the centralized profit structures of traditional stablecoin issuers.

Community Sentiment

Community reaction to USUAL coin has been mixed but generally positive:

- Enthusiastic early adopters are optimistic about its growth potential and the project’s commitment to decentralization.

- Some investors remain cautious due to limited historical data and market volatility.

- Strong community support and engagement are driving positive sentiment across social media platforms.

- Active discussions on crypto forums indicate growing interest in the project’s unique value proposition.

Frequently Asked Questions

What is the USUAL coin?

USUAL is the governance token of Usual Protocol, a decentralized fiat stablecoin issuer. It is part of an ecosystem that works to return ownership and governance of stablecoins to its users. Holders of USUAL tokens have a say in the platform’s ownership and governance framework.

What is the USUAL coin price prediction in INR?

The USUAL coin price prediction in INR is as follows:

- 2025: ₹82 (minimum), ₹275 (maximum), and ₹163 (average)

- 2026: ₹266 (minimum), ₹576 (maximum), and ₹404 (average)

- 2030: ₹541 (minimum), ₹816 (maximum), and ₹696 (average)

- 2040: ₹2,148 (minimum), ₹5,155 (maximum), and ₹3,608 (average)

- 2050: ₹7,303 (minimum), ₹8,334 (maximum), and ₹7,818 (average)

What is USD0 stablecoin?

USD0 is a native stablecoin issued by Usual protocol and is backed by risk-free real-world assets (RWAs) like US Treasury bills and other financial instruments. Unlike popular stablecoins like USDT and USDC, USD0 has a decentralized reward distribution where holders are rewarded with yields generated by the RWAs.

Is USUAL coin a good investment?

Whether USUAL coin is a good investment depends on your investment goals, risk appetite, and portfolio diversification approach. Due to its unique use case of returning value to users, USUAL could prove to be a worthwhile investment. However, it currently has a very limited history, making it difficult to say anything with certainty.

What makes USUAL different from other cryptocurrencies?

USUAL stands out through its community-centric revenue-sharing model, deflationary tokenomics, and focus on decentralized stablecoin issuance. Unlike centralized stablecoin issuers that keep profits for themselves, USUAL redistributes 90% of protocol revenue to token holders, creating a more equitable ecosystem.

Make Informed Decisions About USUAL

USUAL coin represents an innovative approach to decentralized stablecoin issuance, offering a compelling alternative to centralized options by redistributing value back to its community. With its deflationary tokenomics, strategic revenue-sharing model, and growing adoption potential, USUAL presents interesting opportunities for cryptocurrency investors.

However, as with any cryptocurrency investment, potential investors should conduct thorough independent research, carefully assess their risk tolerance, and consider consulting with a qualified financial advisor before making investment decisions. The cryptocurrency market remains highly volatile, and past performance is not indicative of future results.

Stay informed about USUAL’s developments, monitor market trends, and make investment decisions that align with your financial goals and risk profile.

Disclaimer: The content provided in this USUAL coin price prediction blog is purely for informational purposes and should not be considered financial advice. Cryptocurrency investments involve significant risks, including potential loss of capital. Market conditions can change rapidly, impacting the actual performance of USUAL coin. Readers should conduct their own research and consult with a financial advisor before making any investment decisions. Past performance is not indicative of future results. The author and publisher are not responsible for any financial losses incurred as a result of relying on this information. This blog post is for informational purposes only and does not constitute an endorsement of USUAL coin. Regulatory changes and technological advancements can significantly affect the value of cryptocurrencies. This content may contain forward-looking statements that are subject to uncertainty and change. Price predictions are speculative and not financial advice.